Rebalancing and Trading

Trade Up to InvestEdge

Through a single interface, you can quickly produce tax efficient buy/sell lists, compare potential trades to restricted holdings lists, evaluate the impact of transactions on the portfolio, and release trades to a third party order management system.

Unlock Efficiencies

Improve Efficieny

- Realize STP with automated trade uploads to an order management sytem

- Eliminate re-keying of data and manual-entry errors

Simplify Rebalancing

- Create proposed trade lists by rebalancing accounts to models and/or other accounts on the system

- Rebalance portfolios to match targets by asset class, asset subclass, eaquity holdings, and sector

- Monitor pre-trade transactions to ensure compliance with buy/sell lists

Minimize Taxes

- Monitor portfolio and optimize portfolios to models with minimal turnover and capital gains

- Make the best trades at each optimization opportunity to optimize tracking to the client’s strategy

- Rebalance thousands of taxable portfolios in a fraction of the time required by traditional means

InvestEdge includes many options for generating proposed trade lists. For example, portfolios can be automatically rebalanced ot mirror a model portfolio or any other account on the system. Upon request, InvestEdge compares a portfolio’s holdings to a target, and produces recommendations. If a transaction is suggested but not desired, it can easily be excluded.

Firms also gain substantial improvements in efficiency and scalability-thousands of taxable portfolios can be rebalanced in a fraction of the time required by traditional means. Advisors are also better able to demonstrate changes in portfolio tracking error, utility, etc. to show the overall effects of recommended changes. Meanwhile, clients benefit from tax-wise accounts that more closely mirror their objectives.

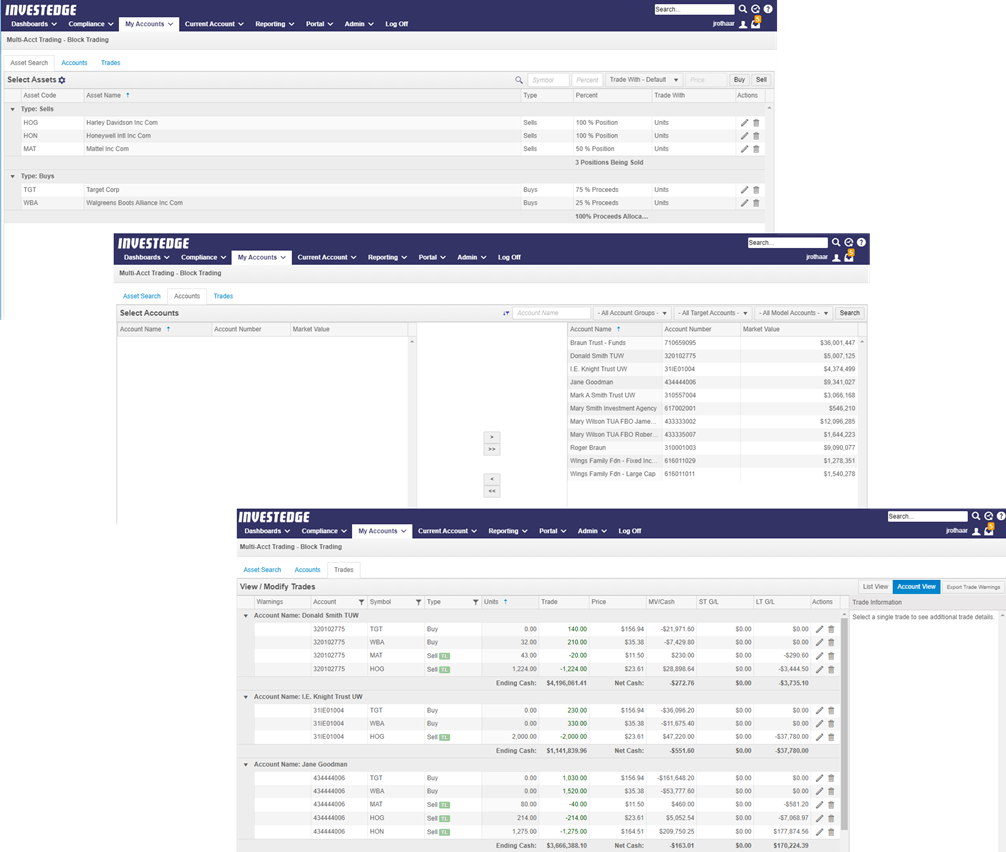

Multiple account level and block trading and rebalancing options...

- Enter Trades

- Select Accounts

- Create/Review Trades