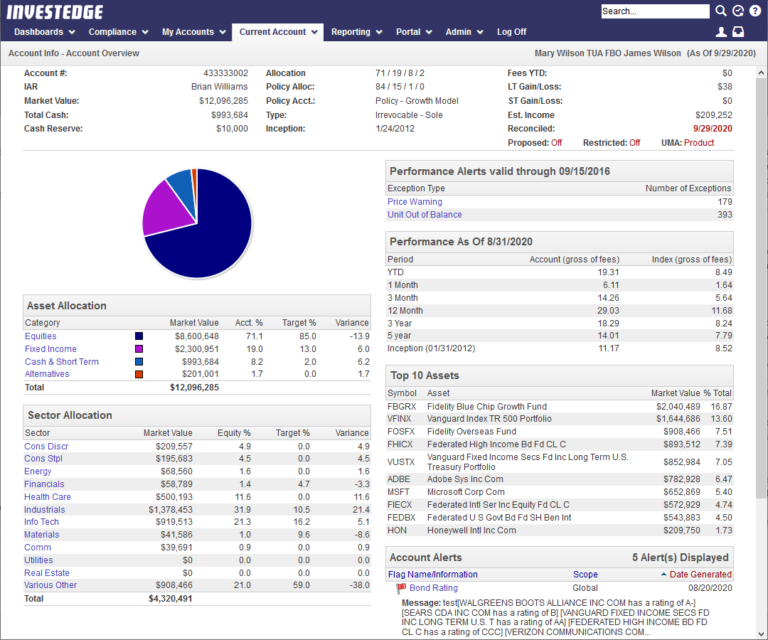

Portfolio Management

Instant Snapshots For Better Decision Making

Each night, InvestEdge automatically imports data from your books-of record system(s), including those from SunGard, FIS Global, or Advent, as well as brokerage systems such as Fidelity and Pershing. And through a partnership with Evare, LLC., InvestEdge can incorporate held-away assets from virtually any custodian. InvestEdge is the only front-office solution to include flexible asset categories-enabling you to categorize assets at a more granular level. In addition to the standard four asset categories (Equities, Fixed Income, Cash and Other) you can define up to ten additional custom asset classes, as well as five layers at the subclass level. Customizable asset classes increase the flexibility of performance reporting, especially when defining indices at numerous levels. As a result, you have a better and more accurate way to present your investment strategies and management styles.

Simplified Access to Account Data

InvestEdge’s portfolio management features enhance efficiencies by organizing vast amounts of account information and presenting it in a manner that is aligned with the daily workflow of advisors.

Powerful &

Productive

Leverage Information

- Unleash data from your books-of-record system

- Aggregate held-away accounts and assets to provide a complete investment picture for clients

- Gain an instant picture of each account’s holdings, allocation, performance, and assets held

- Combine holdings, performance data, vendor data, and other information across any number of accounts for analysis and reporting

Simplify Analysis

- Compare existing holdings with proposed trades to understand the potential impact

- Create and manage investment policies

- Automatically monitor portfolios for exceptions, drift, or other customizable rules

Improve Workflow

- Customize asset categories and subcategories to the unique requirements of the firm

- More accurately present each client’s investment strategy and your management style

- Attach notes, files and documents to any portfolio

InvestEdge also has a partnership with FIX Flyer to add order management and routing to its portfolio management system via the Flyer Trading Network and Order Management System. Flyer’s trade management system is a broker-neutral platform designed to optimize workflows and reduce operational risks at the organizational level by automating and centralizing trading and post trade processing. Flyer Trading Network manages connections to all of the major custodians and brokers with a unified advisor facing API and tailored workflows for wealth management for equities, mutual funds, options, futures and fixed income. Financial advisors gain significant efficiencies by eliminating the gap between order decision and execution. Advisors gain additional efficiency in managing orders and trading decisions across multiple brokers, custodians and strategies.